Your member to cross-sell

It’s no secret that a combination of liquidity challenges, recent bank failures, high-interest rates and inflation have slowed lending activity - for banks especially. In response to these economic conditions, many financial institutions have opted to tighten their credit standards despite low delinquency rates for consumer and commercial loans.1 In spite of these more challenging economic conditions, credit unions have the opportunity to deliver on their mission to serve members’ credit needs and earn new, long-term members in the process.

Especially during challenging times when organizations face budget constraints, the Upstart Referral Network enables credit unions to acquire new members at a low cost. Upstart sources qualified personal loan applicants on Upstart.com and matches them to the credit union based on the credit union’s specific parameters, including their field of membership requirements. This saves the credit union both time and money they would be using to target these prospective members themselves. Many of Upstart’s credit union partners have not only gained new members at a lower cost than what it would cost in-house but have been able to successfully cross-sell these members additional products, increasing the member’s lifetime value (LTV).

Check out how some of Upstart’s credit union partners are successfully cross-selling new members gained via the Upstart Referral Network.

Automated and personalized

product and service offerings

These products include:

Checking and

Savings Accounts

Credit Cards

Home Equity Loans

Auto Loans

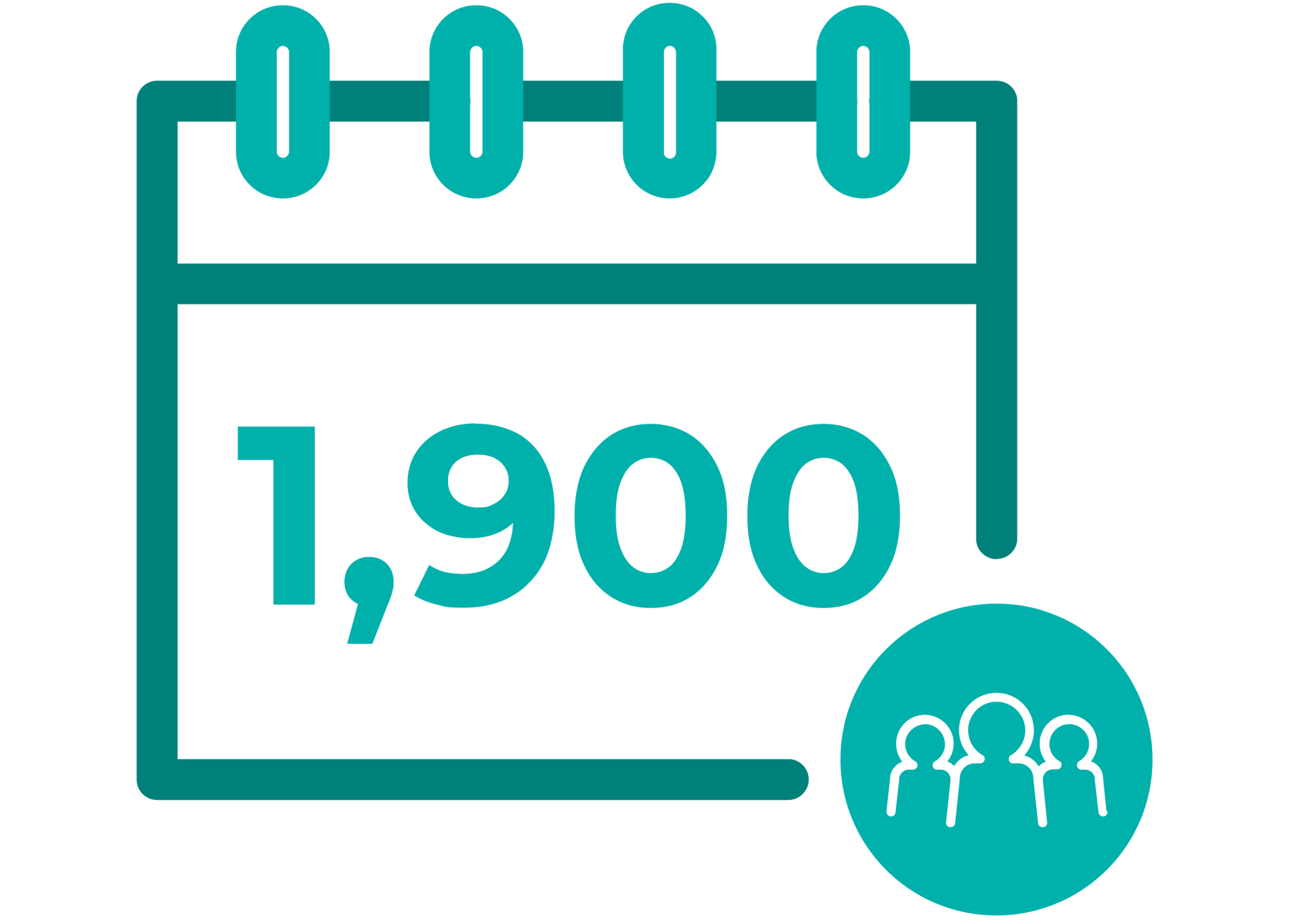

members since launching

Commonwealth Credit Union gained over 1,900 new members with the Upstart Referral Network. To ensure that these members are long-time, sticky members, Commonwealth sends an automated, personalized email follow-up recommending additional products that fit the member’s specific financial needs. To date, 11.1% of members gained through Upstart have purchased additional products and services with Commonwealth, including checking and savings accounts, credit cards, home equity loans and auto loans.

Commonwealth

Credit Union

Asset Size:

$2.2B

Location:

Frankfort, Kentucky

Cultivating members for long-term growth

for Upstart-sourced members compared to other indirect

channels. Products include loan and deposit products.

$10B

Credit union

5,400

new members

over 1.5 years

For one $10B credit union, the Upstart partnership has spanned one and a half years, and the credit union has gained over 5,400 members in the process.

The credit union has achieved a conversion rate that is 2x higher than new members gained through other indirect channels.

Targeted follow-up

sourced through Upstart are

full-service members2

The Atlantic Federal Credit Union has converted ~5% of members gained from the Upstart Referral Network into full-service members. Once memberized, their staff contacts every single person that they fund a new loan for in order to sell them other products and services to deepen the relationship. They are working towards turning 7-10% of new members who come in into full-service members.

- “We set aggressive goals and have surpassed these goals in the third quarter. [Upstart] has done a phenomenal job of meeting those requirements. Every member that comes in is within our two counties.”Jason Reed, Chief Operating Officer, The Atlantic Federal Credit Union

In addition to acquiring qualifying members in Union and Essex counties, Upstart’s identity verification process has both prevented identity fraud and enabled The Atlantic Federal Credit Union to meet all of their NCUA requirements for the Customer Identification Program (CIP).

The Atlantic

Federal Credit Union

Asset Size:

$231M

Location:

Kenilworth, New Jersey

1. Wall Street Journal. “Lending Slowed, Economy Cooled After Bank Failures, Fed Report Shows.” April 19. 2023.

2. Full-service is defined by the member holding a consumer loan, credit card and active deposit account