Inside Vantage West's High-Performing Loan Portfolio

Vantage West knew that both member preferences and changing economic conditions required a shift in its fintech partnership strategy. Consumers wanted a more seamless digital banking experience, and what began as a period of stimulus and excess deposits shifted to a landscape of liquidity constraints, requiring adaptability in a potential partner.

To deliver an Amazon-like personal loan experience and grow membership, Vantage West began its fintech partner search.

Finding a long-term strategic partner

As the executive team began its partner evaluation, one of the key criteria was finding a partner that aligned with Vantage West’s values. Michelle Goeppner, SVP of Consumer Lending and Deposits, explained that the goal of all of Vantage West’s partnerships is to align with their values, benefit members and support scalable, responsible growth.

“When Vantage West is evaluating fintech partnerships, the thing we look at first and foremost is, does the partner align with our values and our corporate mission? And then we look at whether or not they can provide something of value to our members, and can they help us scale and grow our business effectively and responsibly,” said Michelle Goeppner.

Goeppner shared that getting internal buy-in for a fintech partnership, especially one using AI, requires aligning around the member impact. “Sometimes team members can be a little adverse to change, especially with something new. One of the ways that we rally and inspire them to embrace change in an environment that's risky is by starting with the root. We're all aligned, despite different goals, in serving our members and doing what's best by membership,” she said.

Adjusting program levers

At the beginning of the Upstart partnership, Michelle explained that their team took a ‘crawl, walk, run’ approach and worked alongside their dedicated Upstart account manager to set the appropriate guardrails for income, losses and rates. “We started in Arizona, originating just a few million dollars a month to test how the program worked, and then steadily ramped up volume as we gained confidence,” she said.These levers have added some much needed flexibility in the wake of uncertain economic conditions, including 10 interest rate hikes since the partnership began in June 2022, the collapse of Silicon Valley Bank (SVB) and Signature Bank in March 2023 and whatever the future may bring.

Upstart has helped us to serve more affluent borrowers through the T-prime program, and that’s effective for us because it balances our risk. The T‐Prime program has helped us continue to serve the borrowers of modest means because we have that balance.

Sandra Sagehorn-Elliott

President and CEO

Gaining members within core segments

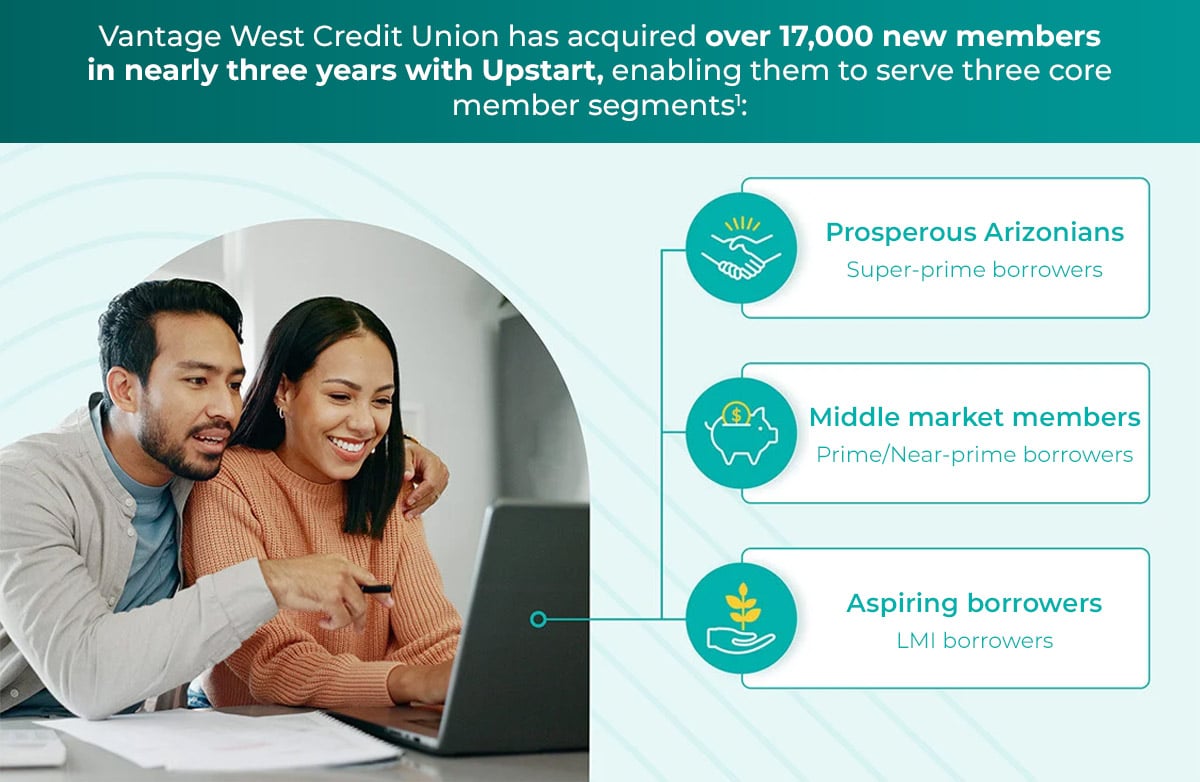

As a credit union very geographically concentrated in the Tucson market, the Upstart Referral Network has provided a way for Vantage West to diversify its geography outside of Arizona and grow members outside of its branch network. “The endless volume potential within our geographic footprint has allowed us to grow and reinvest in our Tucson community,” Goeppner added. Nearly three years into the partnership, Vantage West has gained over 17,000 new members.

Nearly three years since its go-live, Vantage West has gained over 17,000 new members.¹

Furthermore, Goeppner shared that Upstart has enabled Vantage West to better serve their three core member segments:

- "Prosperous Arizonians" with super-prime credit

- Middle-market members with A/B credit and

- Aspiring borrowers who may be new to credit, especially low- and moderate-income (LMI) borrowers

In the summer of 2024, Vantage West launched Upstart’s T-Prime lending program, allowing the credit union to acquire more affluent “super prime” borrowers with credit scores above 720. Sandra Sagehorn-Elliott, Vantage West’s President and CEO, said, “Upstart has helped us to serve more affluent borrowers through the T-Prime program, and that’s effective for us because it balances our risk. The T-Prime program has helped us continue to serve the borrowers of modest means because we have that balance.”

From a performance standpoint, Sharon Grieger, Vantage West’s Chief Risk Officer, added, “Using AI to automate credit decisions has resulted in loans performing well. Our participation in Upstart's prime program allows us to offer competitive rates with instant automated approvals, offsetting losses and bringing in new members.”

In addition to gaining super-prime members, the credit union is also capturing middle market borrowers with A/B credit, but also lending deeper down the credit spectrum without increasing losses. Goeppner reports that credit performance has been “excellent,” with 97 percent of borrowers in repayment.²

Scott Odom, Vantage West’s Chief Financial Officer, elaborated, “So far in our partnership with Upstart over the past three years, the loans have performed according to plan. In the more recent vintages, we’ve actually seen better performance than we’ve planned.”

Using AI to automate credit decisions has resulted in loans performing well. Our participation in Upstart's prime program allows us to offer competitive rates with instant automated approvals, offsetting losses and bringing in new members.”

Sharon Grieger

Chief Risk Officer

Expanding member relationships and new product launches

In 2025, Vantage West also plans to focus heavily on onboarding and cross-selling new members gained from Upstart and launching a new checking account offer.

“We're super excited that we're going to be adding new products into the loan journey. So when someone is taking out an Upstart loan, we're going to offer them a checking account with Vantage West and hopefully ask that they make that loan payment with that checking account,” said Michelle.

Overall, Michelle and the Vantage West team view the Upstart partnership as an integral piece of their goal to use AI and more data points to improve credit decisioning and ultimately create a better digital experience. “When people ask me about my partnership with Upstart, I start by saying that the team is phenomenal. They're highly collaborative and skilled. I feel like they're an extension of my team at Vantage West,” Michelle said.

“So far in our partnership with Upstart over the past three years, the loans have performed according to plan. In the more recent vintages, we’ve actually seen better performance than we’ve planned.”

Scott Odom

Chief Financial Officer

“We're super excited that we're going to be adding new products into the loan journey. When someone is taking out an Upstart loan, we're going to offer them a checking account with Vantage West and hopefully ask that they make that loan payment with that checking account.”

Michelle Goeppner

SVP of Consumer Lending & Deposits

Resources:

- Findings are reported on information collected by Vantage West Credit Union and reported to Upstart from September 2022–July 2025.

- Ibid.