INDUSTRY REPORT

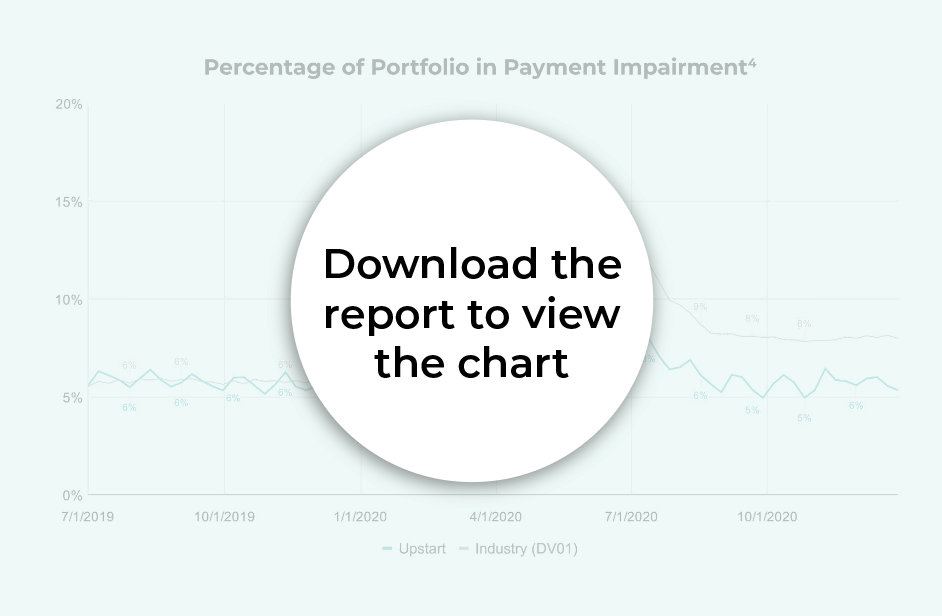

One Year Later: AI Underwriting & Portfolio Performance Through COVID

How consumer loans originated before the pandemic performed through a year of economic uncertainty

Key takeaways

1

At the peak of the crisis, impairment across the Upstart platform increased 40% less than the industry as a whole

2

Fewer borrowers on the Upstart platform required a hardship program, and more of these borrowers began promptly making on-time payments

3

The Upstart Risk Tier, assigned by our model at origination, was 6 times more effective than credit score bands at separating the risk of payment impairment

4

The ability for Upstart's AI model to separate risk tiers translated into significantly lower payment impairment rates for our bank partners

Notable quotes

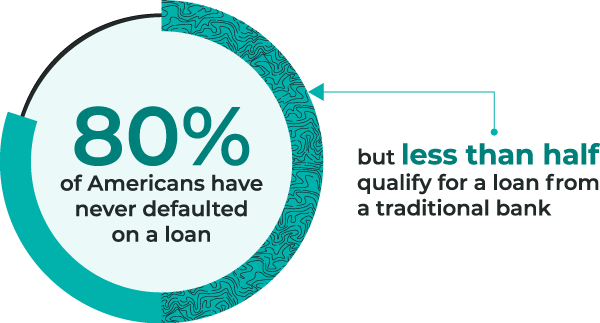

While 80% of Americans have never defaulted on a credit obligation, fewer than half have the prime credit profile needed to qualify for a loan with a traditional bank.”

While 80% of Americans have never defaulted on a credit obligation, fewer than half have the prime credit profile needed to qualify for a loan with a traditional bank.”

We believe that these results will embolden leadership within the credit industry to push forward into a new era of AI-enabled lending.”

We believe that these results will embolden leadership within the credit industry to push forward into a new era of AI-enabled lending.”