Written by Jeff Keltner, SVP Business Development

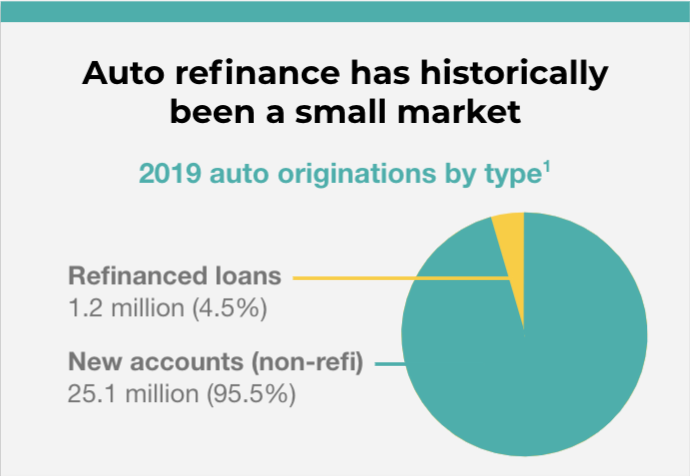

Following mortgages, auto lending represents one of the largest segments of consumer lending for banks and credit unions. However, most of the auto loans these financial institutions provide are to purchase a vehicle and very few are refinance loans. While consumers are contacting their banks and credit unions to refinance their mortgages and to take out personal loans to refinance credit card debt, there’s a distinct lack of auto loan refinance customers.

Herein lies a massive opportunity for lenders. They can increase their growth and satisfy more customers by finding the opportunity in auto loan refinancing. However, banks and credit unions need to focus on and perfect a few things first to win in the auto refi space.

Auto refi has traditionally not been a big part of the mix in auto lending. However, advances in technology have made this a massive opportunity for banks and credit unions.

3 Things Auto Refinancing Lenders Need to Succeed

While there is an opportunity in auto loan refinancing, it’s not as simple as a lender offering refinancing options to their customers. For banks and credit unions to succeed in the auto refi space, they need to execute and improve their capabilities. There is a need to be able to target the right customers, accurately underwrite their risk, and create a faster, more seamless digital underwriting process.

- Precise Targeting

Lenders need to be proactive in creating demand for auto refinance loans given the general lack of consumer awareness of it. To be effective, they need to employ the right targeting and use the correct channels to find the consumers who are paying too much interest on their current auto loans.

2. Underwriting Risk

After finding the right customers and attracting their attention, banks and credit unions need to understand who’s paying too much in interest and determine what risk is acceptable for them to take on. That’s where underwriting comes in.

A sophisticated underwriting process is critical for banks and credit unions to find inefficiencies in existing auto loans that allow refinancing a borrower at a lower rate while maintaining acceptable risk levels for the lender. To be successful, lenders should leverage risk-based AI credit decision models that can individually price risk more accurately. With accurate, risk-based pricing, financial institutions can increase approvals and expand their consumer portfolio within their risk tolerance.

3. Digital Process

Finally, banks and credit unions need to have a digital, highly automated application process for their auto refinance customers. Digital innovation can drive greater efficiency by lowering on-boarding and closing costs for lenders to help increase margins. At the same time, consumers benefit from quicker approvals and an easier application experience which, in turn, can lead in higher completion rates for lenders.

Auto refinance represents a small share of the $1.37 trillion3 in outstanding auto loans. Banks and credit unions have a significant opportunity to expand their auto loan portfolio and deepen their customer relationships.

The Takeaway

Auto refi has traditionally not been a big part of the mix in auto lending. However, advances in technology have made this a massive opportunity for banks and credit unions. Every lender should be looking at this opportunity now to grow a large and profitable auto refi business with:

-

Precise Targeting - lowers CAC to be profitable

-

Underwriting Risk - identifies borrowers paying too much

-

Digital Process -lowers on-boarding and closing costs

1 Source: Household Debt and Credit Report, Federal Reserve Bank of New York, Q4 2020.

3 Household Debt and Credit Report, Federal Reserve Bank of New York, Q4 2020.