On Demand Webinar hosted by NAFCU

Disruption and Digitization in Auto Finance

Val Gui

VP & General MAnager, Automotive Lending

"We’re pairing automation with auto – they’re two interplaying pieces that create a scenario where 1+1=3."

Val Gui

About this webinar:

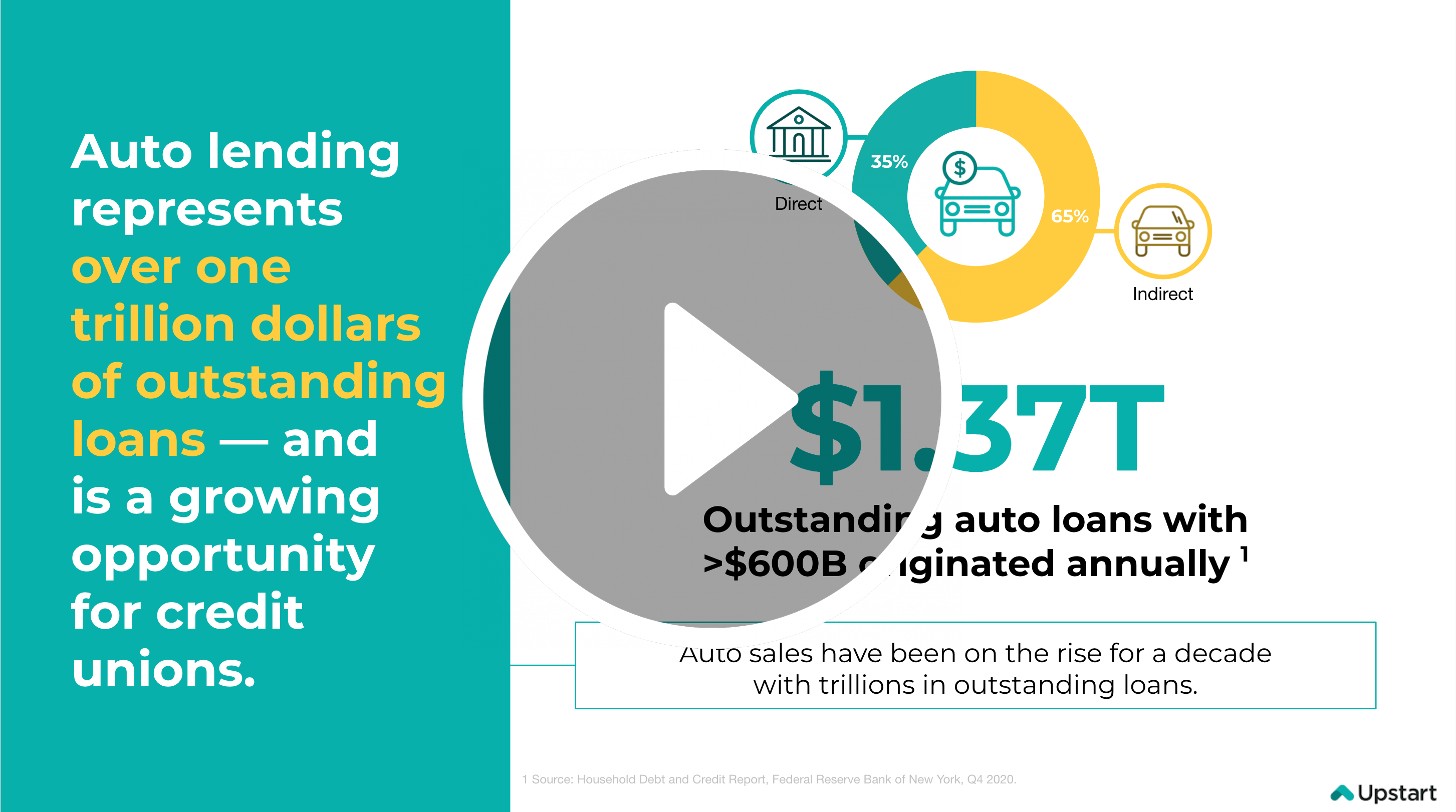

With auto e-commerce companies setting the standard for a fully digitized customer journey, bank leaders must be able to deliver a best-of-breed experience if they wish to compete. With the auto industry rapidly changing due to a shift in consumer behaviors and expectations, lenders have had to adjust their processes to continue to grow their portfolio in an increasingly competitive market. Although the auto industry is still a huge opportunity, with trillions in outstanding loans, banks often struggle to build large, profitable portfolios of auto loans – direct purchase are profitable but hard to grow, indirect is highly competitive with little margin and auto refinance is a largely unexplored channel by most banks.

This recording will cover:

The opportunity in auto financing and e-commerce;

How to harness AI and risk models and an automated digital experience to win members;