Rising interest rates

Navigating loan growth in turbulent times

Introduction

The uncertainty in our current economic environment has caused some lenders to tighten their approach to credit and pull back from some lending activities. However, I believe that this is a moment when AI can help credit unions best serve their communities while properly managing the risk and returns in their portfolios—resulting in higher approval rates and lower cost of credit.

Rather than relying on traditional qualifiers alone, such as credit score and debt-to-income ratio, credit unions can assess these alongside thousands of other variables to generate much more accurate predictions about a borrower’s likelihood to repay a loan. Furthermore, credit unions can create seamless, embedded experiences that create stickier member relationships while also attracting new members.

During uncertain times, credit unions can make short-term decisions that come at the cost of long-term strategic priorities. Given the cyclical nature of the economy, investing in technology during turbulent times is the best way to take advantage of opportunity during better times. Rather than inaction or scaling back, credit unions that double down on digital transformation and disruptive technologies like AI and machine learning cannot only weather challenging times, but continue to grow.

Jeff Keltner

Senior Vice President

of Business Development

Upstart

“Software is eating the world,

but AI is going to eat software.” 1

Jensen Huang

CEO, Nvidia

Q3 2022 state of the market

Recent economic headwinds have made credit unions especially nervous to adopt alternative lending methods.

A combination of the following circumstances have left the credit environment more conservative today than in 2021:

Inflation

The war in Ukraine

The end to the largest stimulus in recent history

As higher levels of perceived risk cause many credit unions to tighten their credit boxes and increase their minimum FICO score threshold, credit unions have a unique opportunity to serve both new and existing members during this time.

Short term consumer loans offer a strong portfolio diversification strategy for credit unions. Especially as mortgage purchases and refinances dry up with rising rates, borrowers need quick access to capital to consolidate their debt. By leveraging an AI fintech partner, credit unions can safely unlock a pool of creditworthy borrowers.

As credit unions look to increase their loan market share in these products, they must balance this growth appropriately against ongoing risk of inflation and recession, especially now that excess savings from the stimulus have dried up. Therefore, credit unions must not only offer a best-in-class digital experience, but augment their processes with AI and machine learning in order to better assess and identify creditworthy borrowers while mitigating risk.

4 keys to safe loan growth

in turbulent times

1) Leveraging AI to accurately predict risk

While banks have traditionally reacted to market turbulence by tightening their credit standards and increasing their interest rates, AI and machine-learning models present the opportunity for a more targeted approach to assess consumer creditworthiness to lend safely while enabling banks to contribute to a more seamless and inclusive credit system.

- Real-time models that consider macroeconomic conditions—By leveraging a modelthat considers macroeconomic factors, such as unemployment rates, banks gain a fuller understanding of where there is increased risk. AI lending platform providers enable banks to continue to meet their loan volume and loss targets because the models employ stress testing using historical data and adjust according to macroeconomic conditions. The model updates in real-time rather than remaining stagnant.

- Full control over risk and returns—With a targeted risk assessment that changes based on macroeconomic conditions, banks can target borrowers who fall within their desired risk tolerance and adjust accordingly as their goals and risk appetite change. Similarly, given the level of risk taken on, banks can turn the dial on their needed returns. Even amidst the current macroeconomic environment, banks on Upstart’s platform have continued to meet their desired volume, return and loss rate targets.

- Create smarter and more inclusive lending decisions—Many banks worry that lending more inclusively is synonymous with taking on higher amounts of risk, yet AI and machine-learning models employ thousands of datapoints to improve the accuracy of measuring credit risk. Upstart rigorously tests its models in production for bias and accuracy and has a strong model governance program that focuses on model explainability.

Upstart’s model approves 43% more Black borrowers and 46% more Hispanic borrowers than traditional scoring models.

It is also important to employ rigorous testing on every loan and application for fairness. By leveraging AI, banks can improve access to credit and contribute to a fairer and more equitable financial system, even in challenging times. In fact, Upstart’s model approves 43 percent more Black borrowers and about 46 percent more Hispanic borrowers than traditional credit score-only models.2 Additionally, 30 percent of borrowers who received a loan through Upstart with a credit score of less than 680 would have been rejected by traditional models.3*

- Fraud protection and verification—Applied to fraud protection and verification, AI can decrease manual processing and increase approvals. In fact, more than 70 percent of Upstart’s loans are approved with no documentation or phone calls necessary.* Additionally, Upstart’s fraud detection has limited fraud to <0.3 percent.5

- Servicing—Finally, when it comes to servicing, credit unions can predict who will become delinquent and even tailor messaging most effective at limiting borrowers at risk of defaulting on their credit obligation. By understanding who is more likely and less likely to default using AI models, credit unions can differentiate their servicing messaging and touchpoints, allowing them to prioritize borrowers that are potentially at higher risk of defaulting versus those who are lower risk.

2) Cost efficiency

One of the largest barriers for credit unions to building or scaling a consumer lending portfolio can be cost. Maintaining both the marketing and servicing resources necessary can be time-consuming and expensive. By partnering with a fintech, credit unions can take advantage of the fintech’s nationwide marketing to acquire new members at a lower cost.

In addition, credit unions can streamline their back office for loan origination without needing to augment their staff for loan processing; this includes credit review, approvals, document collection and review, and more. AI can decrease manual processing and increase approvals—more than 70 percent of Upstart’s loans are approved with no documentation or phone calls necessary.** This allows the credit union to maintain a large consumer lending portfolio without needing to train, deploy, and manage additional resources to handle this new volume.

3) Digitally-optimized experience

Following COVID, demand for truly seamless, all-digital banking services has become the norm, and credit unions that want to attract and retain their members must evaluate the ease of their entire process, from application through funding. With a fintech partnership, credit unions can roll out a mobile-optimized, consumer-friendly experience. Fintechs enable members to borrow anytime, anywhere with their loans originated in minutes rather than days.

Additionally, today’s consumers prefer to rate shop, and online lenders make it easier than ever to compare rates instantaneously. Moreover, many of these online lenders have a national footprint, so financial institutions are not just competing locally, but on a national scale. In order to win these consumers, fintech partners can unlock competitive rates for consumers through risk-based pricing, helping credit unions win more members more frequently.

4) Flexibility and control

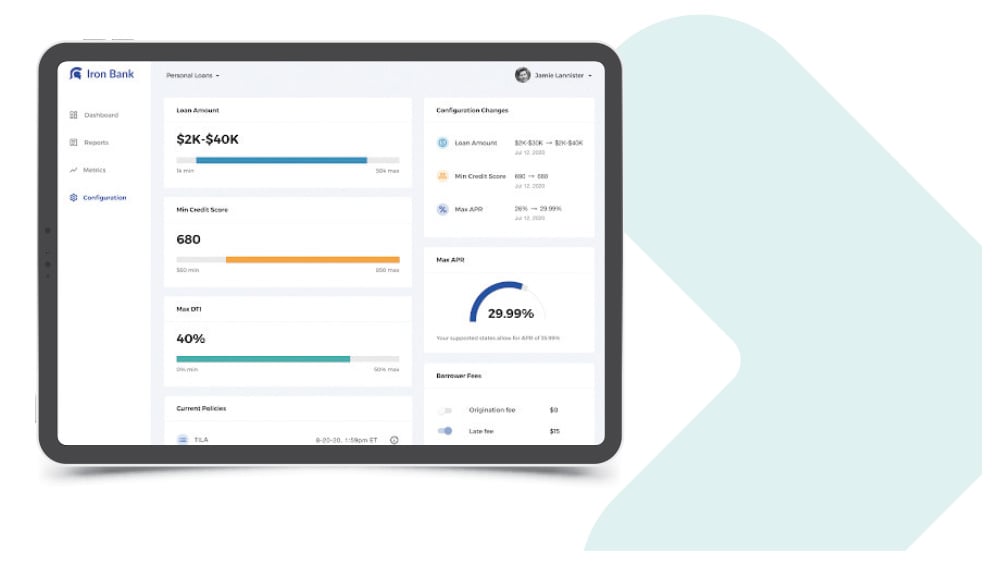

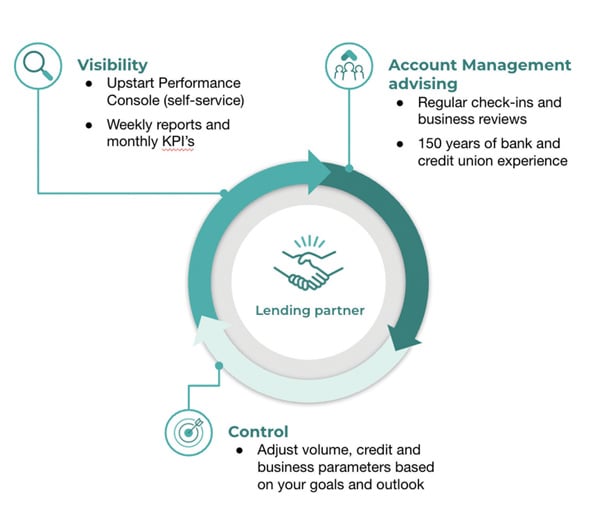

When evaluating fintech partnerships, credit unions should make sure the fintech partner offers full visibility and control over their program. Guided by dedicated account managers, credit unions have scheduled check-ins and business reviews to ensure their return and loss targets are being met.

Additionally, with Upstart, credit unions have full control over their credit box, allowing them full control over loan origination and risk requirements. Credit unions can set their credit score, target returns, annual loss rates, debt-to-income, loan terms, and more, ensuring they have the ability to scale up or down as economic conditions change.

In times of economic uncertainty, agility and control are paramount. With a fintech, credit unions have the option to start with lower loan volumes and gradually scale as their comfort level increases. By closely monitoring and revisiting their loan parameters with their account management team, credit unions can dial volumes up or down in accordance with market conditions.

Conclusion

With rising interest rates, high inflation, and uncertainties about economic recession on the horizon, credit unions need to be doubling down on innovations, like digital transformation and applying AI and machine learning to the lending process. Though some institutions are in the midst of business model changes and cost-cutting, credit unions need to be strategic about which areas of investment will deliver the greatest long-term value.

By leveraging an AI lending platform, credit unions are empowered to make their own decisions and adjustments about risk tolerance and reward in the current environment. Though these providers give credit unions the information about the general market, average return yields, and more, it is ultimately up to the individual credit union to make its own decision based on its business goals and risk tolerance at any point in time.

A lending approach that combines a seamless borrower experience with machine-learning models that factor in macro-driven adjustments will enable credit unions to best serve their members and stay profitable during turbulent times.

1 Simonite, Tom. MIT Technology Review. Nvidia CEO: Software Is Eating the World, but AI Is Going To Eat Software. https://www.technologyreview.com/2017/05/12/151722/nvid-ia-ceo-software-is-eating-the-world-but-ai-is-going-to-eat-software/. Published May 12, 2017.

2 Di Maggio, Marco, Dimuthu Ratnadiwakara, and Don Carmichael. "Invisible Primes: Fintech Lending with Alternative Data." Harvard Business School Working Paper, No. 22-024, October 2021.

3 Ibid.

* As of December 31, 2021, and based on a comparison between the Upstart model and a traditional credit-score only model. Upstart does not collect demographic data on borrowers. Upstart uses standard industry methodology to estimate borrower demographic status to conduct access-to-credit analysis comparing Upstart to traditional credit model outcomes.

* As of 3/31/2022. Fully automated loans are defined as loans originated end-to-end (from initial application to final funding) with no human involvement.

** As of 3/31/2022. Fully automated loans are defined as loans originated end-to-end (from initial application to final funding) with no human involvement.

5 Based on an internal Upstart data analysis of personal loans first payment defaults as of 9/30/2020.