The First Step in Digitizing Consumer Lending

Map Your Customer Experience

Written by Michael Lock

Virtually every retail lender I've spoken with over the last 6 months has placed a priority on figuring out the right path to digital lending. There is broad agreement that the same primary forces pressing lenders for years have now accelerated: Many customers expect a digital experience, bank branches are expensive, all-digital and mega banks are now making decisions in minutes, and lenders with advanced analytics are making far better decisions.

Customer Experience Leads the Way

Customer experience is a clear driver of the move to digital. In a recent study, since the outbreak of Covid, 52% of consumers are visiting physical banks less often, and 49% said they would be happy never going to a physical bank branch ever again1. This makes mapping out the lending experience purely from the consumer’s perspective a needed diagnostic to help build the foundation of your digital strategy. You need all heads around the executive table nodding with a mutual understanding of what your customers’ experiences feel like. With that achieved, you can progress the conversation to identify the value of addressing points of inefficiency and also growth.

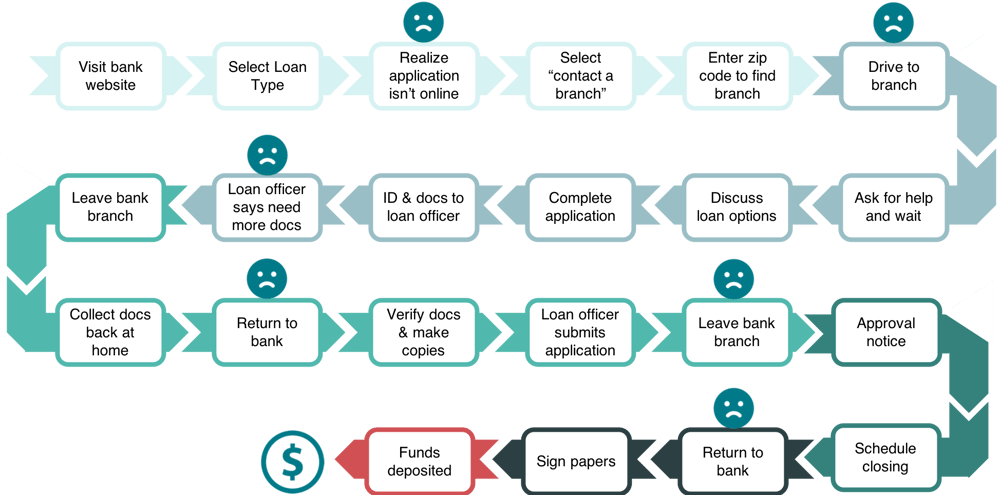

The diagram below lays out what a typical manual lending process generally looks like. You can also download it here and customize it in case you want to drop it into your slide deck.

Customer Experience | Manual Lending Process

>> Download and customize the diagram

This visual representation of a manual lending process from the customer’s perspective lets us know it’s a complex and time-consuming experience. From inquiry to funds deposited, manually processed loans typically drag consumers through a 3-7 day (if not longer) journey. Lenders will likely identify many friction points (frown faces) in their customers' experiences. This has very real brand implications for banks, not to mention the impact on growth from competitive losses and decreased pricing power.

Banks should be laying out the customer experience in a way that’s simple to facilitate executive stakeholders thinking through the entire lending experience. When considering a move to digital lending, understanding the customer experience and consensus building are essential.

1 Online Banking Spikes in Pandemic, DepositAccounts by LendingTree, August 2020