UPST IPO

A letter from our

Co-Founder & CEO, Dave Girouard

I left Google in 2012 to found Upstart with Anna and Paul.

Fast forward 8 years, and today marks an important milestone for Upstart.

Upstart (UPST) has become a publicly traded company.

When we started the company, we were convinced that technology and data science could improve access to affordable credit, but we were a little fuzzy on the details. It seemed obvious that there was room for improvement: Why should a credit score invented 30 years ago, prior to the emergence of cloud computing and modern data science, decide who is approved for a loan and who isn’t?

Simply put, credit unlocks opportunity and mobility - and thus the price of credit equals the price of the American dream. This is why we founded Upstart.

Lending is broken

Considering how central lending is to the economy, it’s stunning how ineffective current approaches to credit origination are. In June of 2020, commercial banks in the US issued almost $15 trillion in loans.1 Yet the models used to predict whether a loan will be repaid are much closer to a roll of the dice than to an omniscient lending deity.

By way of example, four in five Americans have never defaulted on a loan, yet less than half have a credit score that would qualify them for the low rates that banks offer.2 The implication is eye-opening: with a smarter credit model, lenders could approve almost twice as many borrowers, with fewer defaults.

Artificial intelligence is the fix

Credit is an obvious use case for artificial intelligence (AI). First, lending involves sophisticated decisioning for events that occur millions of times each day. Second, there is an almost unlimited supply of data that has the potential to improve the accuracy of credit decisions. Third, given the costs and risks associated with lending, as well as the scale of the industry, the potential economic wins from AI are dramatic.

How does AI change lending? It starts by vastly expanding the information used to inform a credit decision. Then, it utilizes sophisticated machine learning algorithms that can tease out the relationships between hundreds or either thousands of variables. And finally, the system learns and improves on its own. Applied across the entire credit origination funnel, AI can reduce friction, eliminate costs, and mitigate risks associated with lending.

The wins from AI lending are compelling. Studies we completed with several large US banks suggested that Upstart’s model could approve up to three times the number of borrowers at the same loss rates as traditional models.3

With an AI-based system, banks can lend responsibly in any economic environment, with a system that responds quickly and intelligently to changes in employment levels and economic output. This isn’t just theory: during the employment shock of the recent COVID-19 pandemic, when unemployment increased from about 4% to 14% in just a few weeks, Upstart partner banks experienced immaterial impact to the performance of their loans.4

The wins from AI lending are compelling. Studies we completed with several large US banks suggested that Upstart’s model could approve up to three times the number of borrowers at the same loss rates as traditional models.

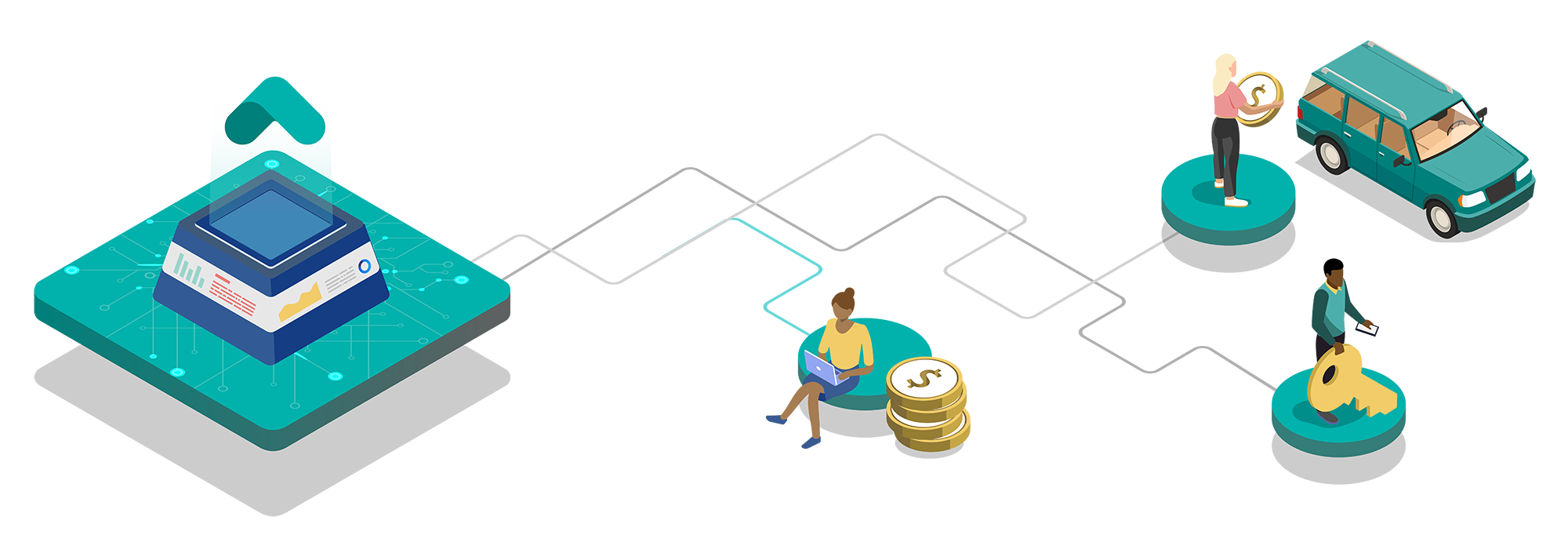

A partner to banks

While many Fintech companies aspire to become the bank of the future, we’re not one of them. Instead of competing with banks, we decided to partner with them, helping banks navigate and thrive through one of the most foundational technology transformations in history.

While a handful of our country’s largest banks may aspire to build an AI-powered lending platform, thousands of others will look to form strong and reliable technology partnerships in order to secure their future. We aim to partner with them.

While “going public” is a milestone that we all are proud of, it is just the beginning. As we cross this milestone, our goal is to accelerate helping our bank partners to grow customer households, enhance risk management, and approve more borrowers at lower rates, while eliminating every bit of friction associated with the process.

We have a true north at Upstart - to bring more people into the world where the credit system works, to unlock opportunity and mobility for them so that money isn’t a daily concern, and to write a story about lending of which we can all be proud.

Dave Girouard

Co-founder & CEO, Upstart

1 Statista: Value of Loans of all Commercial Banks in the United States from March 2014 to August 2020, September 2018.

2 Based on an Upstart retrospective study completed in December 2019, which defined access to prime credit as individuals with credit reports with VantageScores of 720 or above.

3 In an internal study, Upstart replicated three bank models using their respective underwriting policies and evaluated their hypothetical loss rates and approval rates using Upstart’s applicant base in late 2017. Such result represents the average rate of improvement exhibited by Upstart’s platform against each of the three respective bank models.

4 Bureau of Labor Statistics, U.S. Department of Labor, News Release: The Employment Situation - August 2020, September 2020.