Watch the Replay to hear more about:

Discover how Colony Bank is leading the way in delivering digital solutions to fuel loan growth responsibly, even in uncertain times.

Hear from the Chief Executive Officer and Chief Credit Officer about how they are leveraging technology and additional data to continue to serve their existing customers' borrowing needs and still acquire new customers in today's macro environment.

Leonard H. Bateman, Jr., has served as Executive Vice President and Chief Credit Officer since June 1, 2020. He joined Colony Bank as Senior Vice President and Senior Credit Officer through the merger of Colony Bank and Calumet Bank in May 2019. Bateman served as President and Chief Executive Officer of Calumet Bank from 2012 until the merger, having joined Calumet Bank as Senior Vice President – Chief Lending Officer and one of the founding officers of Calumet Bank in 2007. Bateman’s banking experience spans nearly 25 years in various positions of increasing responsibility with banks throughout Georgia. He is a past board member of the Community Bankers Association and the Community Bankers Committee of the Georgia Bankers Association. Additionally, he has held past positions on the board of the Troup/Chambers County Habitat for Humanity serving as both Treasurer and Chairman and has served on the West Georgia Medical Center Foundation committee.

Heath Fountain was appointed President and Chief Executive Officer of Colony Bankcorp, Inc. on July 30, 2018. Mr. Fountain most recently served as President and Chief Executive Officer of Planters First Bank in Hawkinsville, Georgia, from 2015 to 2018, where he led growth initiatives that included adding two new markets, a secondary market mortgage division and increasing loans and deposits over $50 million in three years. Prior to joining Planters First Bank, he served as Chief Financial Officer of Heritage Financial Group and HeritageBank of the South from 2007 to 2015. Mr. Fountain joined the Board of Directors for Colony Bankcorp in July 2018 and serves on its Executive committee.

Ed Walters is the VP, Account Management for Lending Partnerships at Upstart. With over 25 years of financial services and management consulting experience, Ed has held various leadership roles driving consumer lending growth and establishing fintech partnerships, building PMOs to support bank transformations and acquisitions, improving business resiliency, and leading technology development. He now leads the function at Upstart working directly with financial services partners to provide an all-digital lending experience, enabled by AI to their clients.

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

Originate more auto refinance loans profitably

Refinance loans with compelling offers

Acquire new customers

Provide a fast and seamless application process for consumers

Automate approvals with minimal fraud rates

Trust Upstart to manage the entire process including stips and lien perfection

Price and predict risk with accuracy

Increase approvals within your risk tolerance

Maintain full control of your credit policy

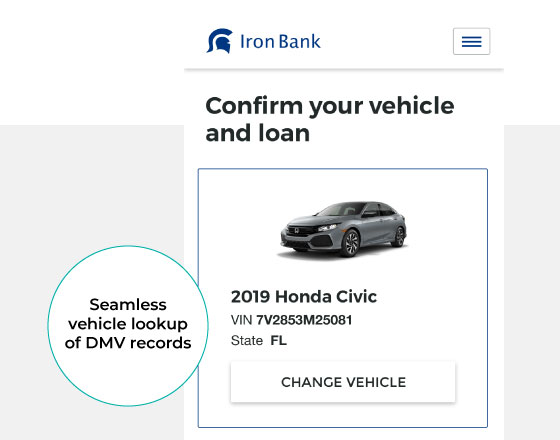

Bank-branded, mobile-friendly application is pre-filled with existing customer information, making the process quick and easy.

Vehicle and loan details such as VIN or license plate are automatically pulled.

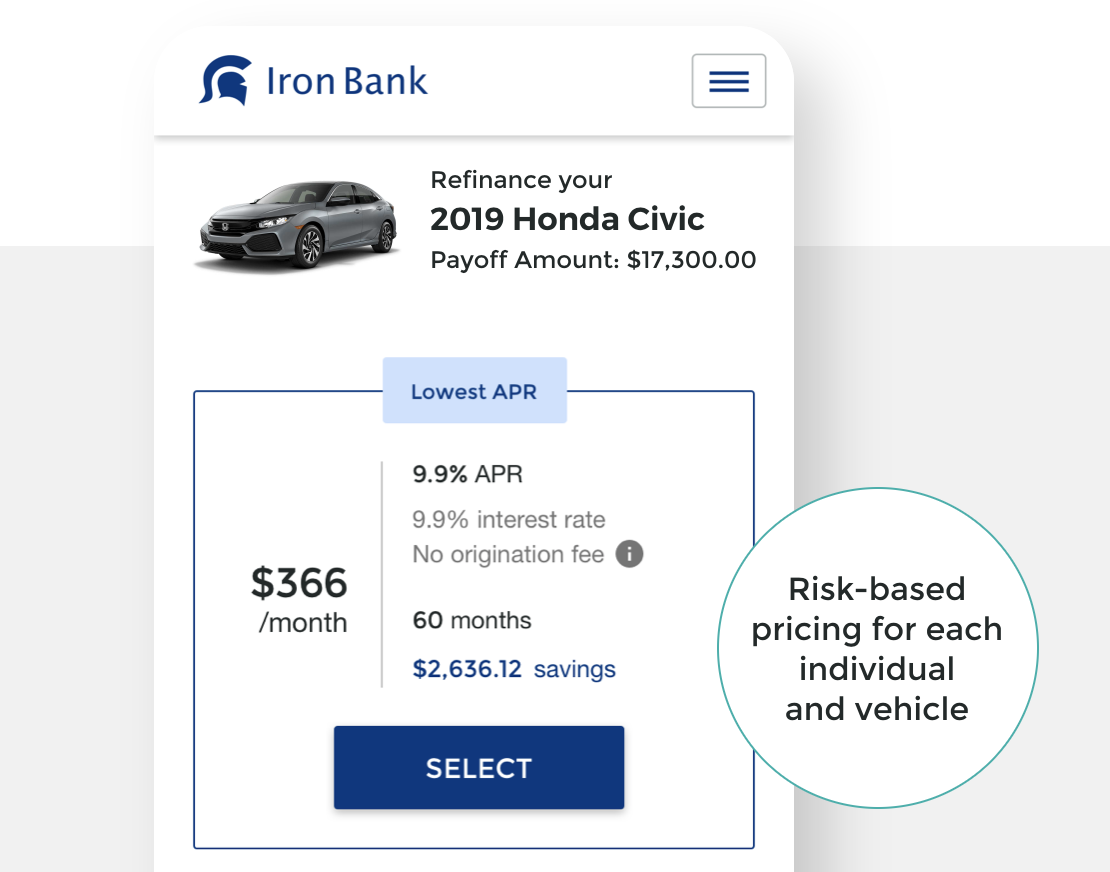

Our risk-based AI model prices customers within your credit parameters resulting in higher approvals and lower losses.

Asset valuation is pulled from third party services and then leveraged in loan pricing.

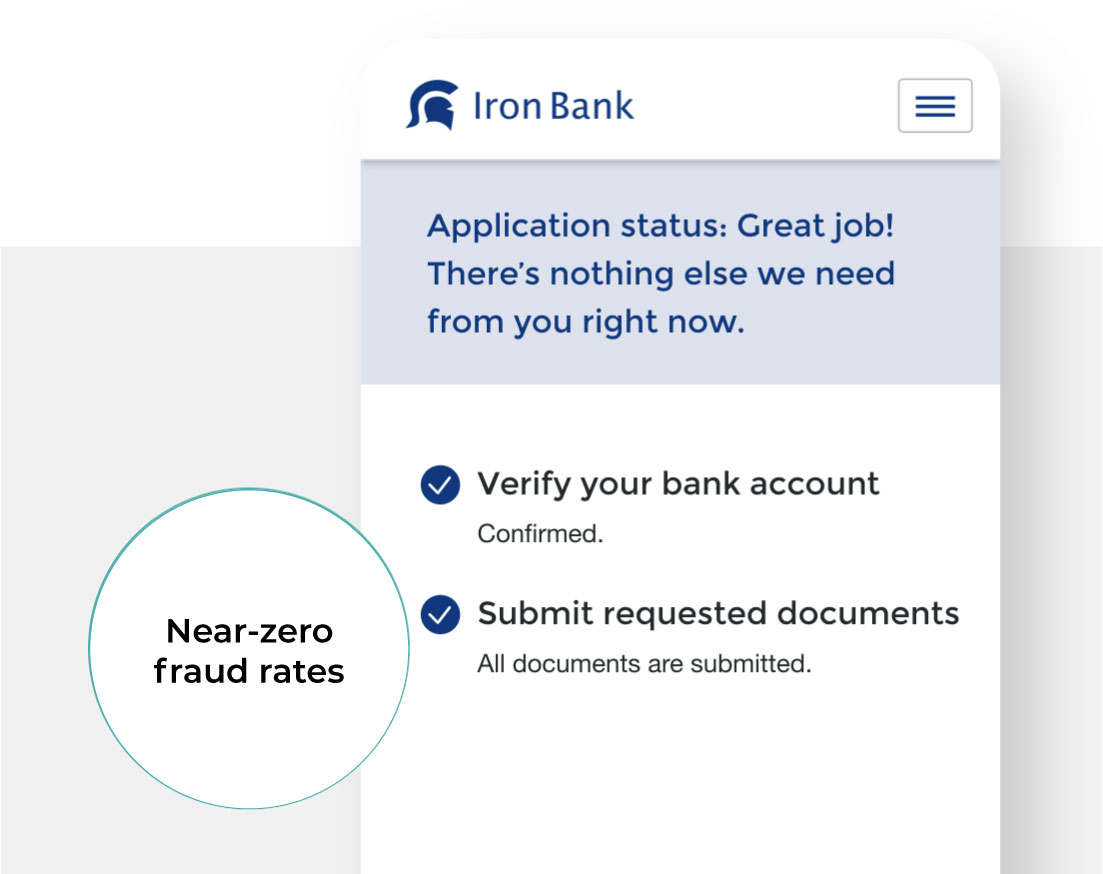

Customer information is verified with many applicants approved automatically.

Our expert staff manages all stips requested for higher-risk applications.

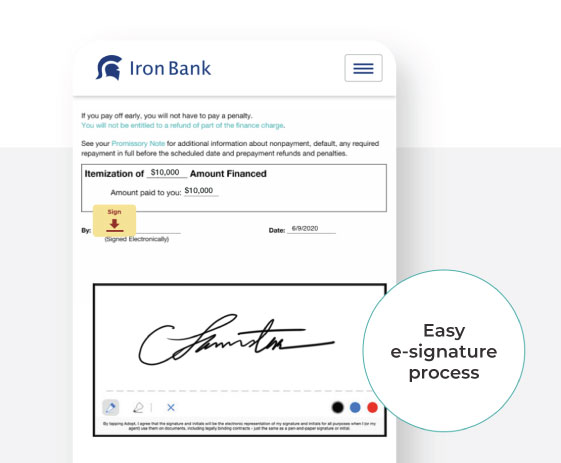

We provide an e-signature process with our refinance verification.4

Funds are sent directly to the previous lender – and payoff is verified.

Upstart handles title management for both electronic and paper titles creating a seamless experience for your bank and consumers.

Apply a wide array of qualifying criteria such as minimum credit score, maximum debt-to-income ratio, loan sizes, loan-to-value ratios, and more.

Configure rates to meet your desired return on assets tailored to your risk appetite.

Approve borrowers that meet your risk profile – our model predicts the probability and timing of default.