Auto refinance represents a small share of the $1.37 trillion3 in outstanding auto loans. As consumers look to save money, banks have a significant opportunity to expand their auto loan portfolio and deepen their customer relationships by partnering with Upstart.

Upstart for auto refinancing is powered by our AI lending platform which enables fast, all-digital originations with accurate risk-based pricing.

Originate more auto refinance loans profitably

Refinance loans with compelling offers

Acquire new customers

Provide a fast and seamless application process for consumers

Automate approvals with minimal fraud rates

Trust Upstart to manage the entire process including stips and lien perfection

Price and predict risk with accuracy

Increase approvals within your risk tolerance

Maintain full control of your credit policy

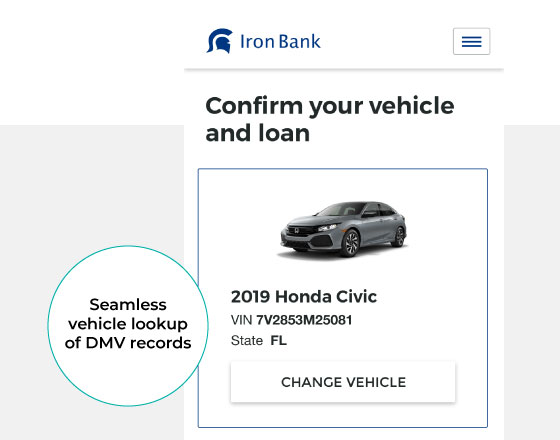

Bank-branded, mobile-friendly application is pre-filled with existing customer information, making the process quick and easy.

Vehicle and loan details such as VIN or license plate are automatically pulled.

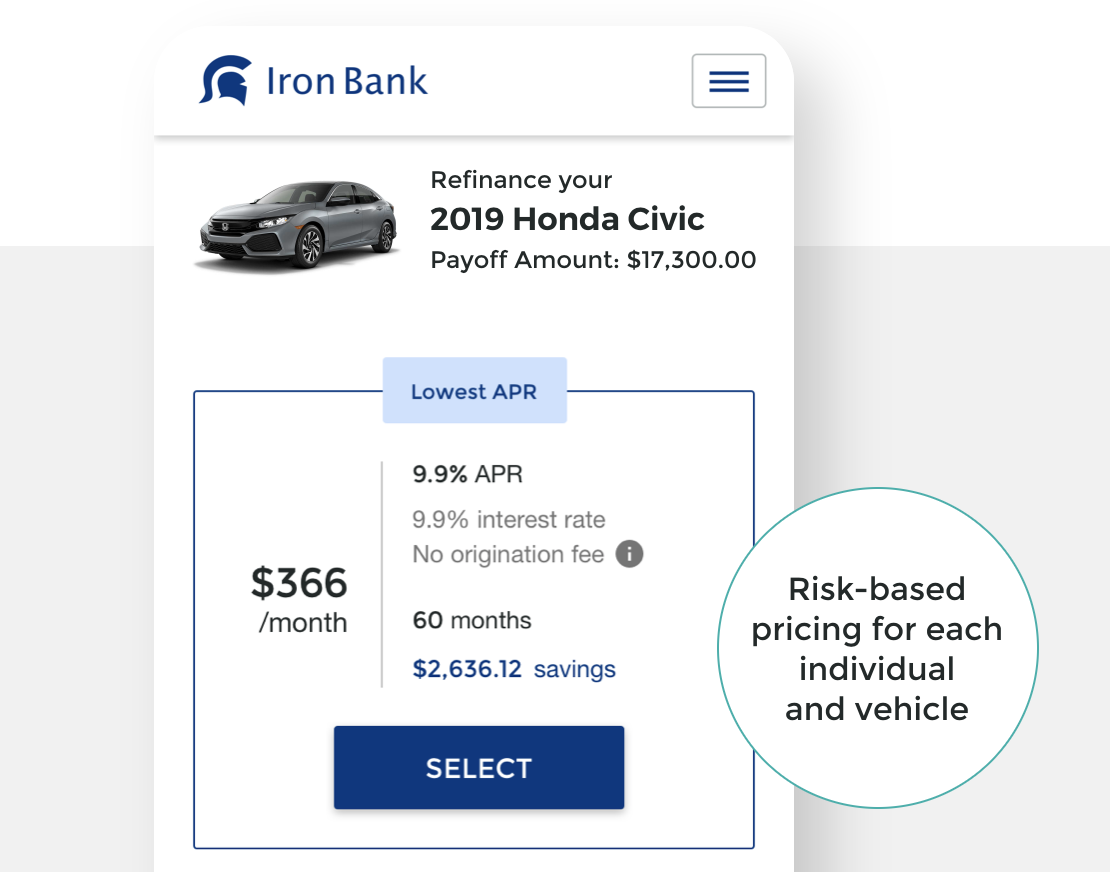

Our risk-based AI model prices customers within your credit parameters resulting in higher approvals and lower losses.

Asset valuation is pulled from third party services and then leveraged in loan pricing.

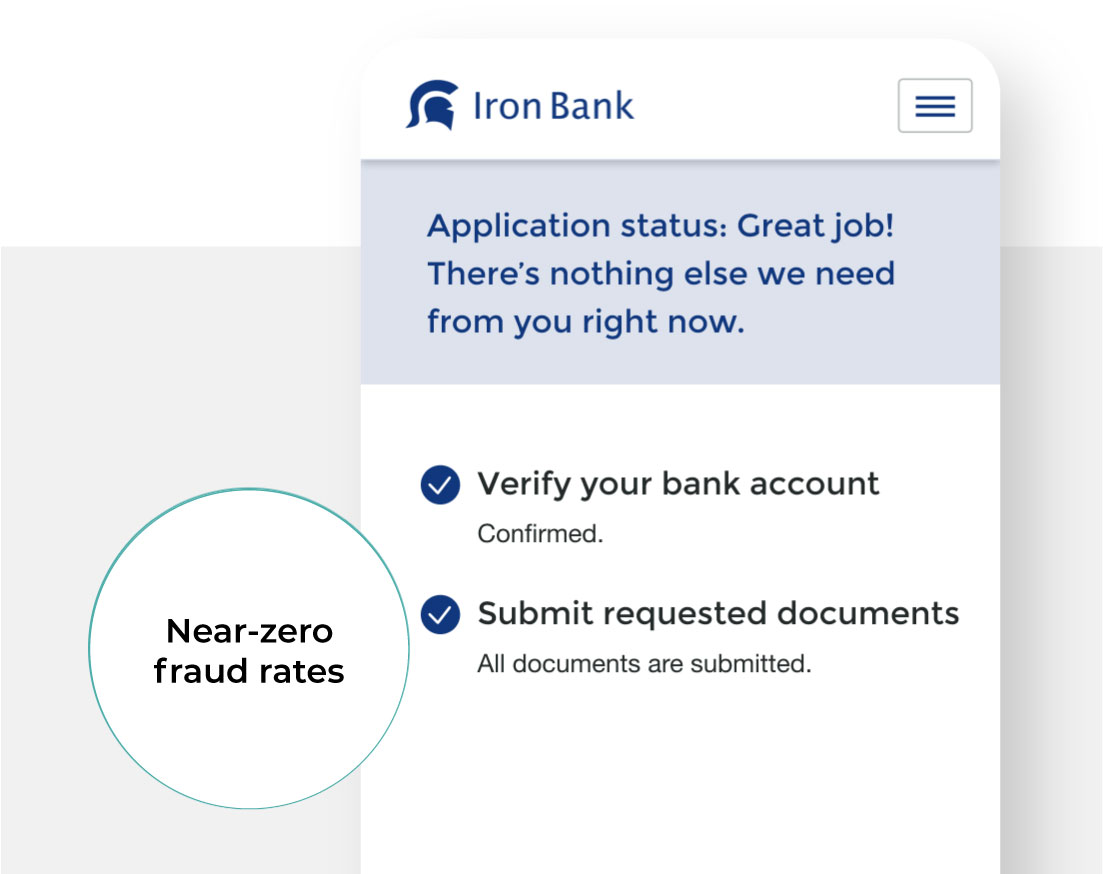

Customer information is verified with many applicants approved automatically.

Our expert staff manages all stips requested for higher-risk applications.

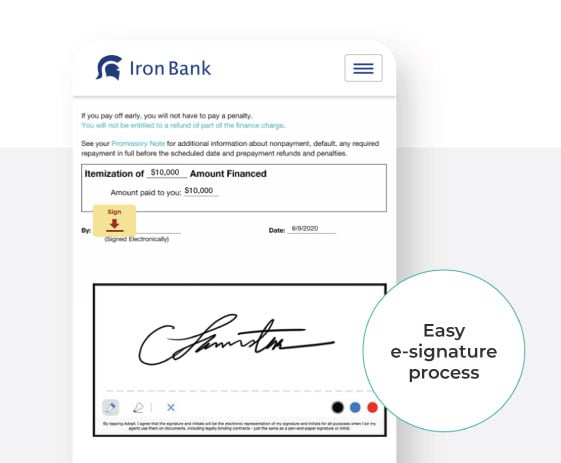

We provide an e-signature process with our refinance verification.4

Funds are sent directly to the previous lender – and payoff is verified.

Upstart handles title management for both electronic and paper titles creating a seamless experience for your bank and consumers.

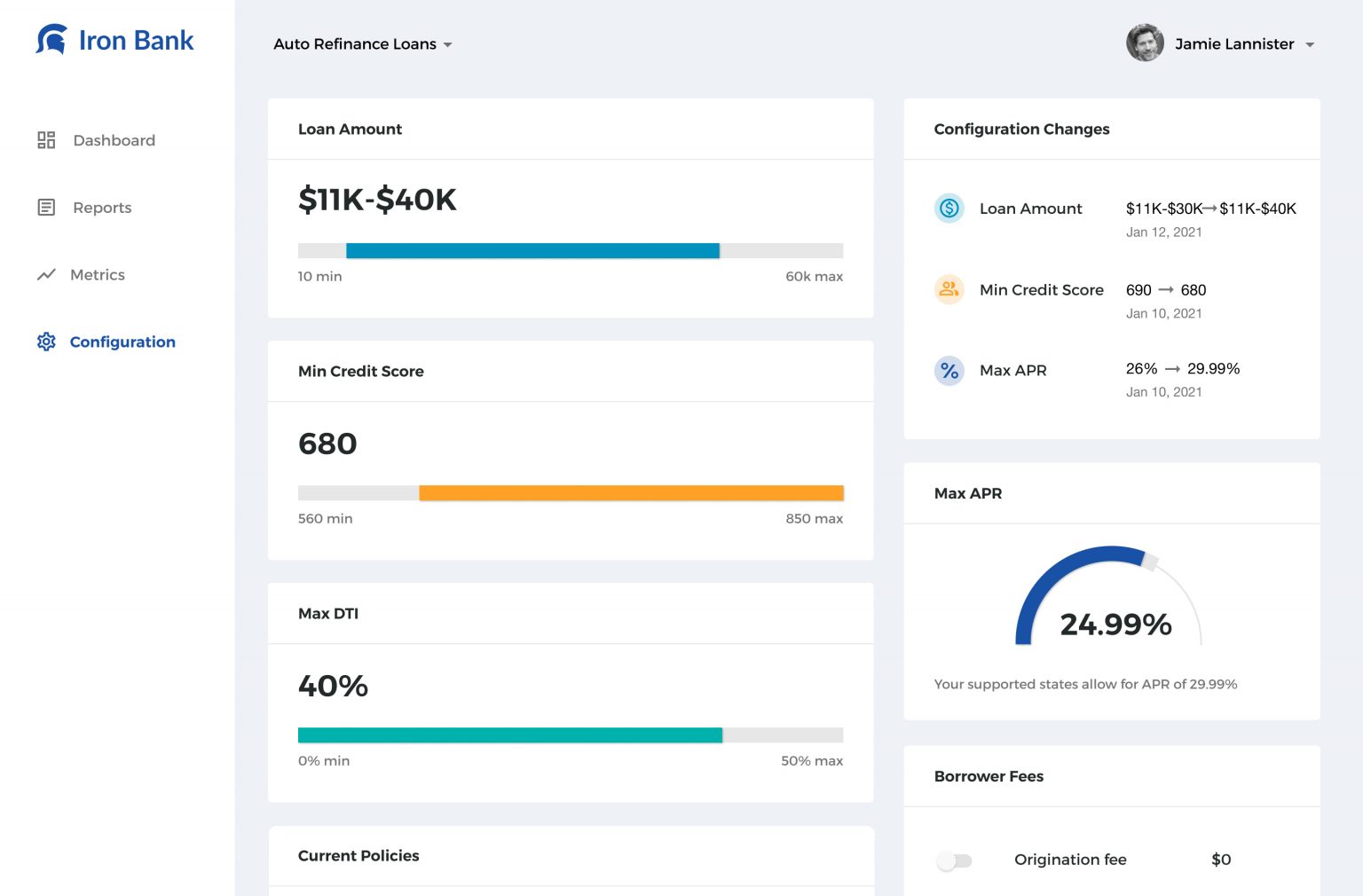

Apply a wide array of qualifying criteria such as minimum credit score, maximum debt-to-income ratio, loan sizes, loan-to-value ratios, and more.

Configure rates to meet your desired return on assets tailored to your risk appetite.

Approve borrowers that meet your risk profile – our model predicts the probability and timing of default.