Minimize your losses.

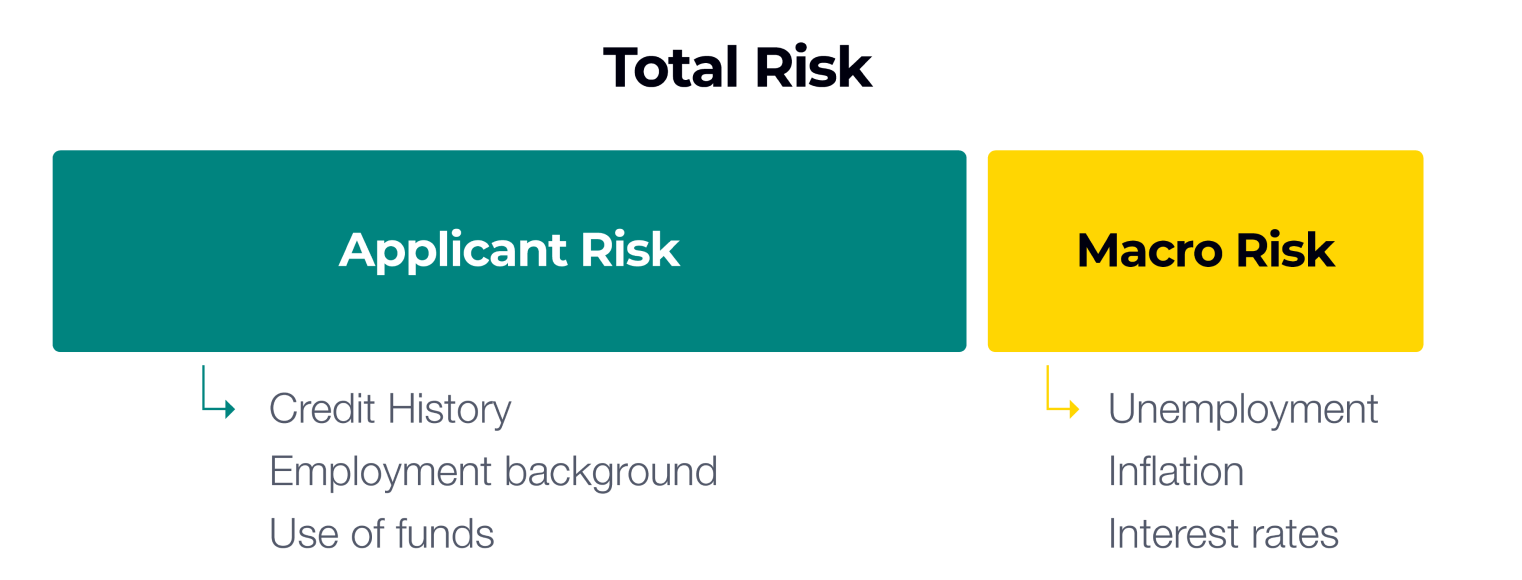

Like an Apple AirTag™, Upstart’s AI credit decisioning uses thousands of data points to minimize risk and manage loss rates (for your loan portfolio, not your car keys).

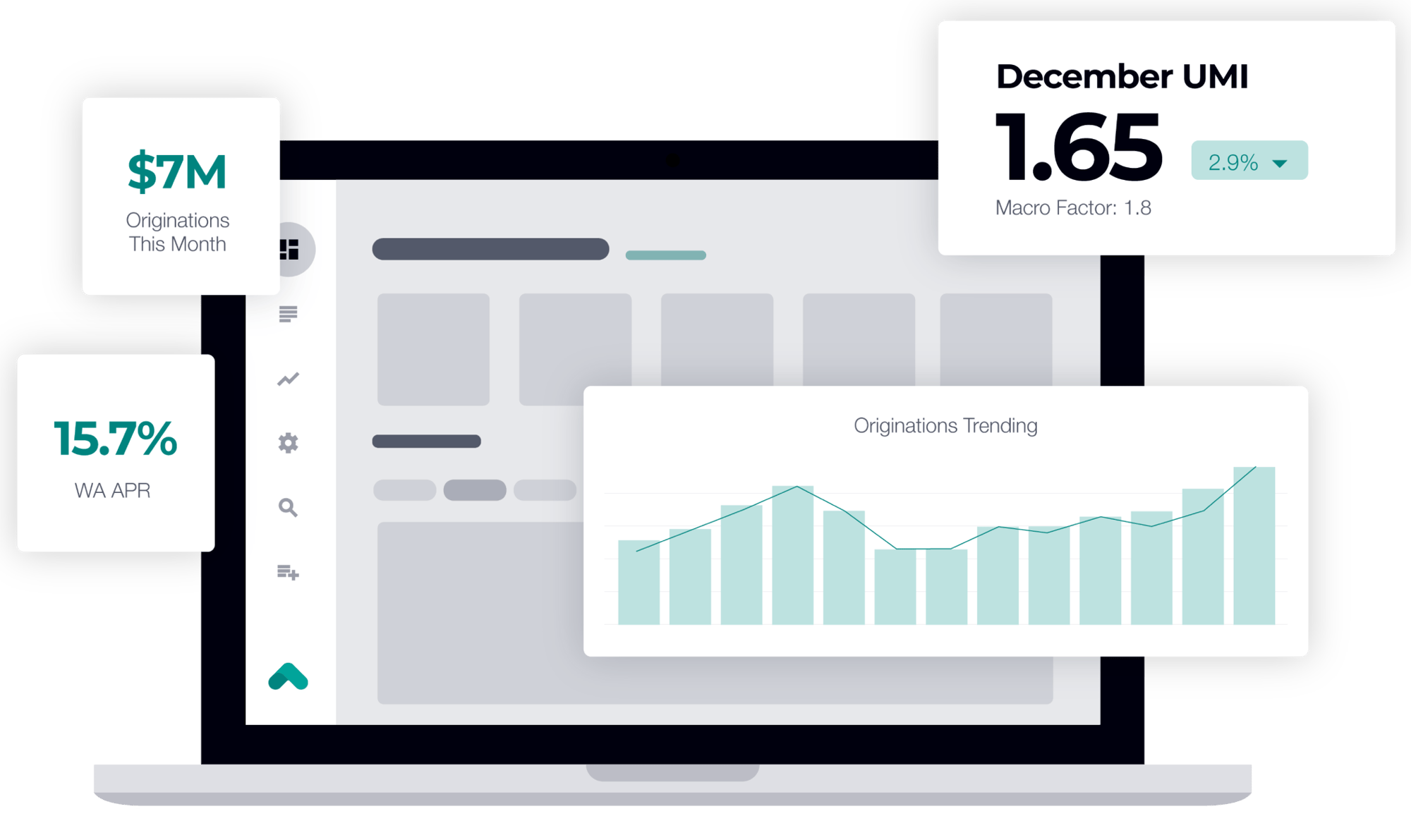

Upstart provides banks and credit unions with the tools to lend through any macroeconomic cycle. Set your credit parameters, then select your program's target geographies and returns. And just like that, the loans (and new customers) flow into your core system and the Upstart Performance Console, where you can keep track of your AI-powered loan performance.

.png?width=313&height=287&name=04%201%20(1).png)

The power of prediction.

It’s hard to imagine a better case for AI than lending.

Say goodbye to traditional scorecards centered around a handful of metrics. With over 10 years of repayment history across $36B of originations, our patented loan-month model predicts the risk of both default and prepayment for each month of each loan. Experience more precision in credit performance than ever before — with net annualized returns 11-27% higher than industry average.1

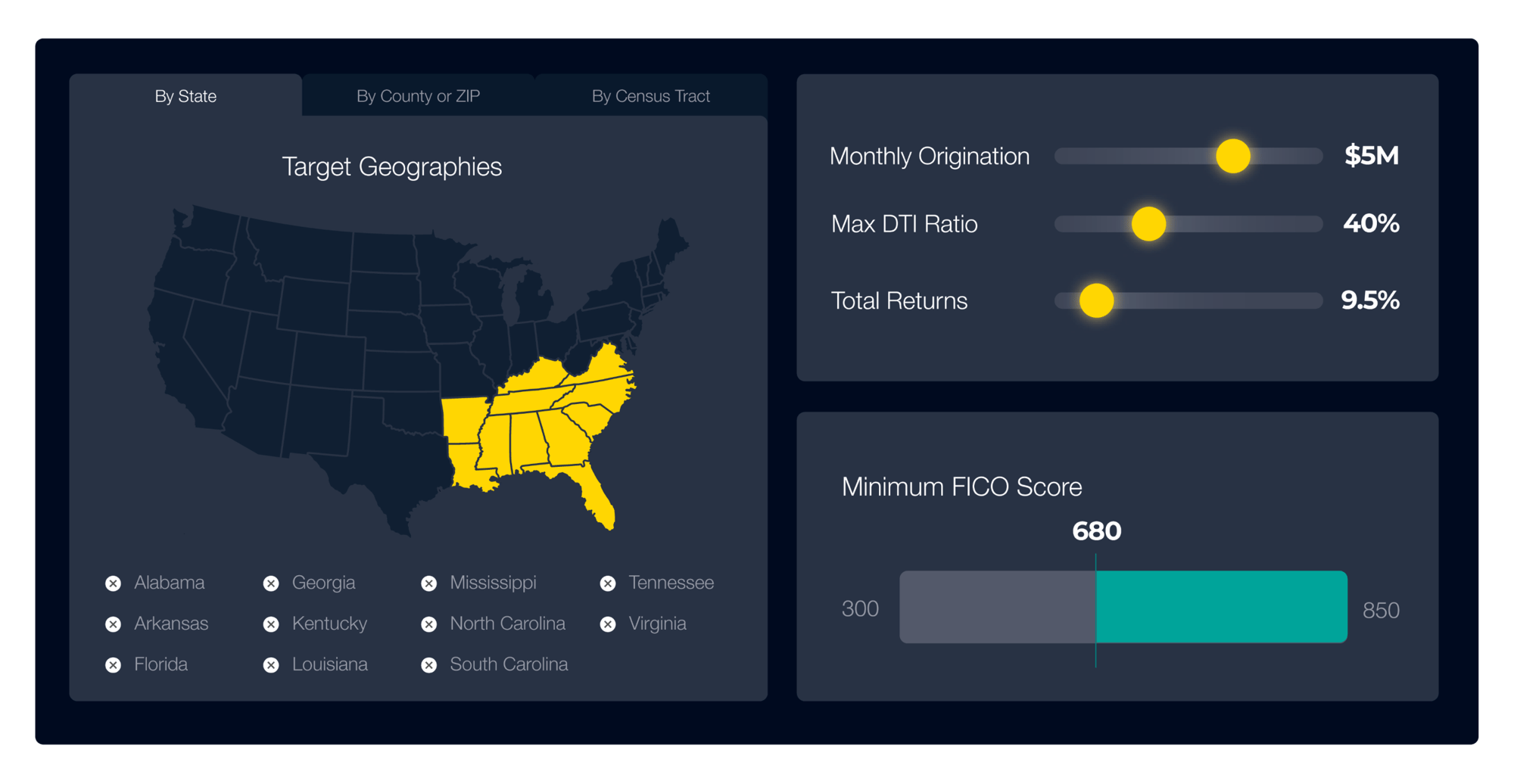

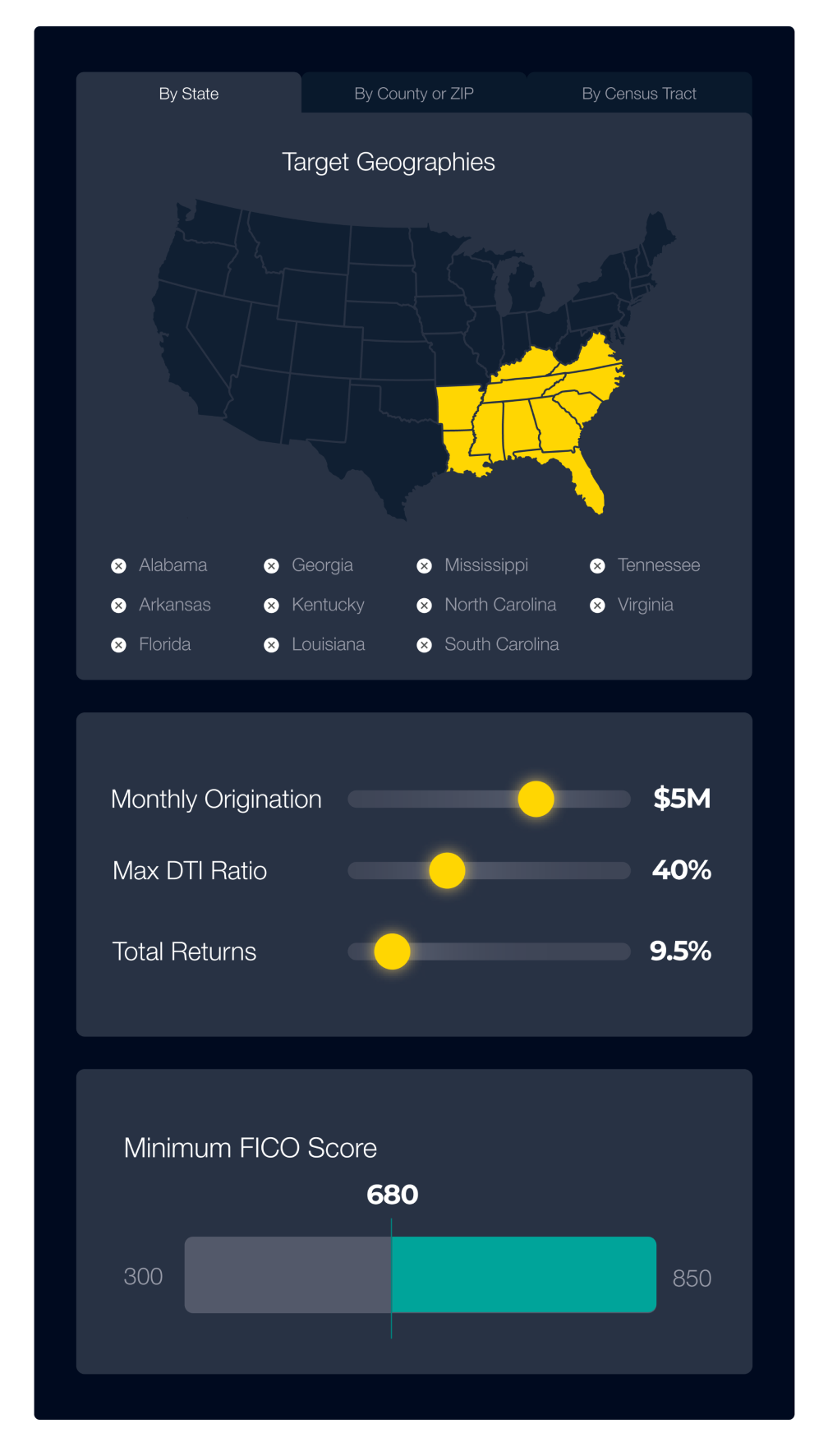

Your program.

In your hands.

Choose your target geographies and borrower characteristics, set your target returns, and watch as loans begin to flow. Make adjustments to your program at any time. Whether you're looking to expand to a new state or simply gain a high-yield, low-duration asset class — Upstart’s Referral Network gives you a reliable way to reach your goals while staying fully in control of your program.

your new customers.

724

Average credit score

$122,384

Average annual income

73%

of borrowers have some form of post-secondary education

Transparency is built in.

With the Upstart Performance Console, you can keep tabs on your portfolio: anytime, anywhere. Your team has full visibility into performance, making sure your program is meeting expectations on a loan-by-loan or month-by-month basis. Plus, you’re in the capable hands of our account management team, many of whom have served as bank or credit union executives themselves.